H-D Q1 North America Unit Sales -24%

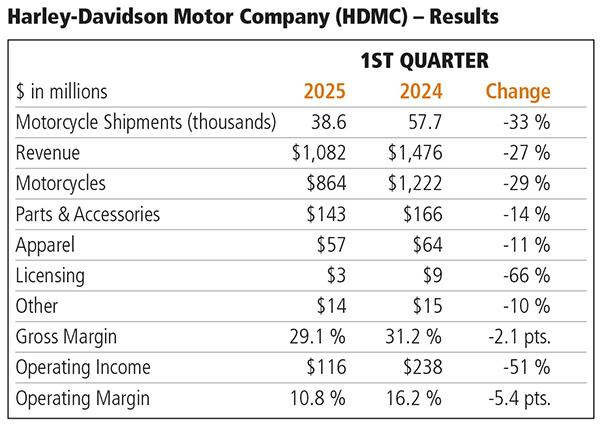

On the first day of May, 2025, outgoing Harley Chairman, CEO and President Jochen Zeitz cited the widely documented "historically low" levels of consumer confidence, and an established recessionary environment in the US motorcycle market, for a massive -27% Q1 collapse in domestic US motorcycle unit sales (20,892 units) and HDMC revenue ($1.082bn).

Straw-clutching remarks attributed to Zeitz included - "Our first quarter results were ahead of our expectations in many areas, while retail sales in the U.S. came in softer than anticipated.

"We remain focused on navigating the challenging economic and tariff environment, through diligent execution of our cost productivity measures, supply chain mitigation, tight operating expense control and reducing dealer inventory.

"In addition, we remain committed to driving retail sales through increased marketing initiatives as we enter the riding season" he said.

Because of changed model year timings, that bought the MY2025 announcements "closer to the riding season" most of the costs of what appears to be designed to be a Marketing Development Fund promotional mega-blitz will start to be incurred during Q2.

One major change in policy that emerged in Zeitz' remarks to analysts was the announcement (as anticipated in AMD last month) that Harley is to reverse its failed price-point strategy.

Zeitz cited the high cost of re-developing what he called Harley's core business (namely the Tourers, principally) as soaking up some 80% of available engineering investment capital in the past five years, implying that only now is Harley in a position to address 'entry level' opportunities.

Contrary to prior statements and a core pillar of the Hardwire strategy, Zeitz stated that they believe they can indeed sell "highly affordable" lower displacement models and do so profitably.

The plan is to bring some model year announcements forward, back into the Fall - which is when, historically, they had always taken place. Therefore, the Fall of 2025 will see confirmation of two lower price, lower displacement models, including the return of what he described as "an iconic classic cruiser."

The collapse of unit sales was strikingly in line with the decline in revenue from motorcycle operations. North Americas saw a 24% Q1 unit decline to 20,900 units (down from 27,500 for the year-ago). Global total unit sales were down by -21% at 31,000 for the quarter overall (down from 39,400 units in Q1, 2024.

Of the international regions, Asia Pacific unit sales were down by -28% to 4,400 units, due largely to softening demand in China and Japan (down from 6,000) and were essentially flat in Latin America at 600 units.

Only Europe (EMEA) showed a pulse at 'just' -2% down (5,200 units from 5,300 in 2024) - though Harley also posted a historically low quarterly European market share of around 2% from some 5% in Q1 2024; Harley's European market share hasn't that low for some 20-30 years. It has to be acknowledged though that the European motorcycle market is still running at record or near record levels, certainly in 21st Century terms.

First quarter global motorcycle shipments decreased by -33%, which was "mostly expected as dealer inventory reduction efforts remain ongoing" but also reflects the softer than expected demand environment. Global dealer inventory was down by -19% in Q1 with domestic US inventory down by -23% compared to QW1 2024.

The 27% reduction in revenue was said to have been primarily driven by the planned decrease in wholesale shipments and unfavorable foreign currency landscape, partially offset by favorable mix, favorable global pricing and net incentives. Parts & Accessories revenue was down 14% and Apparel revenue was down 11%, due to lower customer traffic at dealer stores.

In terms of Q1 tariff impacts Harley said that additional Q1 tariff costs were incurred of $9m, but that they anticipate a $130-$175m headwind for 2025.

Like all manufacturers the company is implementing mitigation measures as, where and when they can but that compared to historically much higher 'foreign component' percentages, 75% of all components purchasing and 100% of all assembly of domestic models is now in the United States.

Part of the Hardwire Strategy had been to seek substantial production savings and that although it will have taken a little longer than the intended 5-years, they will have achieved some $257m of production savings from 2022-2024 and anticipate a further $100m in each of 2025 and 2026.

Indeed, this was not the only respect in which Zeitz was bullish about achievements relative to the ambitions outlined in Hardwire.

He claimed that in stock market terms, including dividends and other mechanisms for returning shareholder value, "HOG outperformed peer group" competitors by 10% in the past five years, 3% in the past three years and by 7% in 2024. This must primarily be a reference to Polaris, though as a much broader based powersports business it isn't a directly valid metric.

During the first quarter, Harley repurchased $87m of shares (3.4 million shares) on a discretionary basis.

Consolidated operating income in the first quarter was down 39%, driven by a decline of 51% at HDMC, partially offset by an increase of 19% at HDFS. Consolidated revenue in the first quarter was down 23%, driven largely by the HDMC revenue decrease of 27%.

Addressing the rumours that Harley is looking at selling off its finance arm, in remarks to investors neither Jochen Zeitz or, separately, CFO and Commercial Operations President Jonathan Root didn't entirely rule it out.

While there are no definitive plans to do so at present, there being no plan or deal on the table, they both made it clear that they were open to ideas. It was clear from their remarks that, in the context of the pressure that Harley is under, if they were made an offer that they considered too good to refuse then they would indeed be likely embrace it.

At LiveWire there was a modest improvement to report, in pure balance sheet management terms at least. The operating loss 'improved' by $9m or 32% lower than the Q1 2024 loss. Consolidated operating income margin in the first quarter was 12% relative to 15% in the first quarter a year ago; Q1 operating loss was $20m.

LiveWire revenue for the first quarter decreased by 42%. The revenue decline was due to lower electric motorcycle unit sales (Q1 LiveWire unit sales were just 33 machines, compared to 117 in Q1 2024) and lower STACYC electric bike sales.

It became apparent that Harley would no longer give LiveWire an open check book. Zeitz confirmed that Harley would now actively seek external capital for LiveWire, if and when needed. He was clear that Harley itself would not provide LiveWire with additional investment above or beyond the presently agreed and in-place line of credit of up to $100m. He also projected 2025 LiveWire losses of $59m.

First quarter HDMC gross margin was down 2.1 points, due to the negative impact of lower volume on operating leverage, partially offset by favorable pricing. First quarter operating income margin was down 5.4 points due to the factors above, while operating expense was $24m lower than a year ago.

HDFS' operating income increased by $10m in the first quarter or 19%. This was due to a lower provision for credit losses and lower operating expenses relative to a year ago, as financing receivables declined modestly.

Interest expense in the first quarter was largely flat relative to a year ago. Total quarter ending financing receivables were $7.4bn, which was down 6% versus prior year, due to a decrease in retail loan receivables and commercial finance receivables.

HDI generated $142m of cash from operating activities and had cash and cash equivalents of $1.9bn at the end of the quarter.

Due to the uncertain global tariff situation and macroeconomic conditions, Harley has withdrawn its full year 2025 financial outlook from February 5, 2025.

Going back to the 'straw clutching' - among the remarks Zeitz made to analysts, he said that unit sales trend for the period February, March and April saw a "sequential" improvement over 2024 and appeared to be suggesting that April 2025 was in fact ahead of April 2024 in unit sales terms.