Polaris Q3 U.S Retail Growth of +15% Drives Dealer Inventory Lower

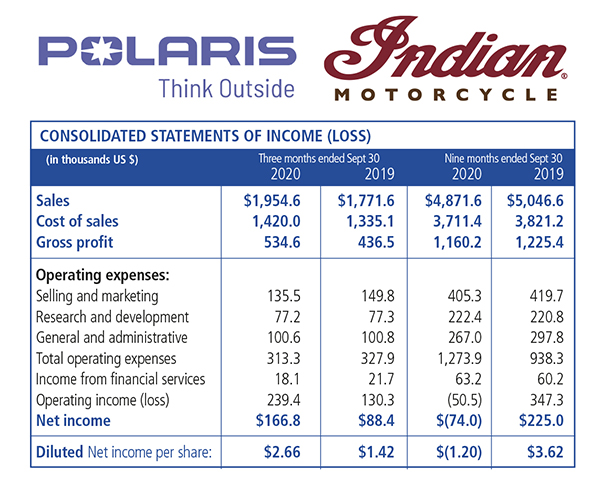

Polaris has reported Q3 sales +10% at $1,955m, with net income of $167m/$2.66 per diluted share. Retail demand is reported as remaining strong "benefiting company performance as both new and existing customers continued taking advantage of off-road vehicles, snowmobiles, motorcycles and boats to enjoy the outdoors while maintaining social distancing etiquette."

Gross profit was +22% (to $535m for Q3) with reported gross profit margin at 27.3%, "primarily driven by positive product mix and lower promotional costs." Operating expenses decreased -4% to $313m - "Operating expenses were lower primarily due to the company's ongoing cautionary approach to spending given the pandemic-generated economic uncertainty."

Motorcycles segment sales, including PG&A, totaled $167m, up +11%, driven primarily from increased sales of Slingshot and PG&A. Gross motorcycle sector profit for Q3 was $16m compared to $9m for 2019 Q3. "The increase in gross profit margin was driven by a decrease in promotional costs and lower European Union retaliatory tariffs as more motorcycles were produced in the Poland manufacturing facility for the region."

motorcycle segment sales +11%

North American consumer retail sales for Indian Motorcycle increased in the low-forty percent range during the third quarter of 2020 (mid-forty percent range when Slingshot units are factored in) in a weak mid to heavy-weight two-wheel motorcycle industry that was down low-single digits percent (the U.S. market is stated by Polaris to have been up low-single digits percent for Q3 when three-wheel vehicles are included).

Polaris Chairman and CEO Scott Wine is quoted as saying: "Our continued strength in the third quarter reflected the broad-based consumer demand for our industry-leading powersports products and tremendous execution by our Polaris team and dealers.

"Their focus and determination enabled Polaris to generate double-digit sales increases in ORV, Motorcycles and Boats, which were somewhat limited by supply chain capacity constraints. I am extremely proud of the diligent and efficient efforts of our team to mitigate these supplier disruptions and drive a three-year high in quarterly gross profit margins.

"Demand has remained strong as Q4 started and we expect our sales and earnings momentum to continue for the rest of the year. This pushes our expectations for overall company performance to exceed our pre-COVID-19 targets for 2020 - demonstrating our confidence in the team to accelerate production as we manage through continued challenges.

"Thanks to the dedication, innovation and customer-centric work of our entire Polaris team, whom we are working relentlessly to keep safe, we are realizing tremendous progress from our strategic investments in supply chain and digital transformation, electrification and breakthrough product development programs. I am very optimistic about the future growth and profitability prospects for Polaris and our stakeholders."

Off-Road Vehicles (“ORV”) and Snowmobiles segment sales, including PG&A, totaled $1,289m for the third quarter of 2020, +12%, "driven by broad based strength across ATV and side-by-side sales." Q3 ORV wholegood sales were +13%. "Polaris North American ORV retail sales increased low-double digits percent for the quarter, with both side-by-side vehicles and ATV vehicles up low-double digits percent. The North American ORV industry was up low-twenties percent compared to Q3 2019." Q3 Snowmobile wholegood sales were -34% at $70m.

motorcycle segment gross profit up at $16m

Global Adjacent Markets segment sales, including PG&A, were -6 % at $107m. Aftermarket segment sales were slightly up at $237m. Transamerican Auto Parts (TAP) sales were +1% at $194m. The company's other aftermarket brands sales were -1%. Boats segment sales were +30% at $155m, "driven by broad based strength across all brands."

Parts, Garments and Accessories (PG&A) sales were +28% for Q3; international sales to customers outside of North America, including PG&A, were +9% at $203m.

|

| The well received Indian Challenger - Q3 North American consumer retail sales for Indian Motorcycle increased in the low-forty percent range. |

Net cash provided by operating activities was $676m for the nine months ended September 30, 2020, compared to $436m for the same period in 2019. Total debt at September 30, 2020, including finance lease obligations and notes payable, was $1,864m. The company’s debt-to-total capital ratio was 66 percent at September 30, 2020 compared to 64 percent at September 30, 2019. Cash and cash equivalents were $821m at September 30, 2020, up from $122m at September 30, 2019.

"Given the continued strong retail environment, the company is raising its sales and adjusted earnings guidance for the full year 2020. Sales are now expected to be in the range of $6,925bn to $7.0bn, up two to three percent compared to 2019 adjusted sales of $6,783m.

Financial and Operational Highlight

- Q3 reported sales +10% to $1,955m

- Q3 reported net income was $2.66 per share

- Q3 North American retail sales increased +15% led by strength in ORV, Motorcycles and Snow. Boats doing well also.

- Q3 gross profit margin 27.3%, up 270 basis points over prior year - "primarily due to positive product mix and lower promotional costs"

- Q3 dealer inventory levels -55% "due to strong retail sales growth"

- Q3 liquidity profile "remains solid" with debt/EBITDA at 2.45 times and total liquidity of $1.5bn at quarter end Raising full-year 2020 sales with sales up in the range of 2% to 3%