Harley Q2 Unit Shipments -15% Due to Two-Week Production Suspension; 2022 Guidance Unchanged

As had been widely anticipated, Harley unit shipments in Q2 were impacted, to the tune of -15%, by the widely reported approximately two-week production suspension caused by a regulatory compliance matter at a third-party supplier.

Despite that, HDMC Revenue only down by -5% "with global pricing and growth with Apparel offsetting much of the negative impact from the temporary production suspension."

In fact, HDMC Operating Income margin was actually up by 1.2 points versus the same period of 2021 at 15.1%, which speaks to good management of resources, good price control, lower operating expense and lower EU tariffs offsetting the impact of the suspension.

Jochen Zeitz, Chairman, CEO and President Harley-Davidson, is quoted as saying: "Reaffirming our guidance for the year, despite the production suspension, demonstrates the effectiveness of our Hardwire strategy and the power of our brand.

"Now, with the suspension being behind us, we are fully focused on mitigating the impacts of the volume loss with the ambition to deliver on our Hardwire II goals, in year two of our five-year strategy."

As forecast by AMD, the original schedule for the SPAC floatation of LiveWire as an autonomous publicly quoted business (albeit still around 74% owned by H-D) continues to slip. The merger transaction between LiveWire and AEA-Bridges Impact Corporation is "now expected to list at the NYSE in late September" instead of mid-Spring.

In detail, Harley's Q2 results show Q2 HDMC consolidated revenue down -4%, driven primarily by HDMC revenue down -5% as a result of the production suspension in the second half of May. Consolidated operating income decline of 1% reflects 3% growth at HDMC and a decline of 9% at HDFS - due to an expected higher provision for credit losses as the credit environment normalizes.

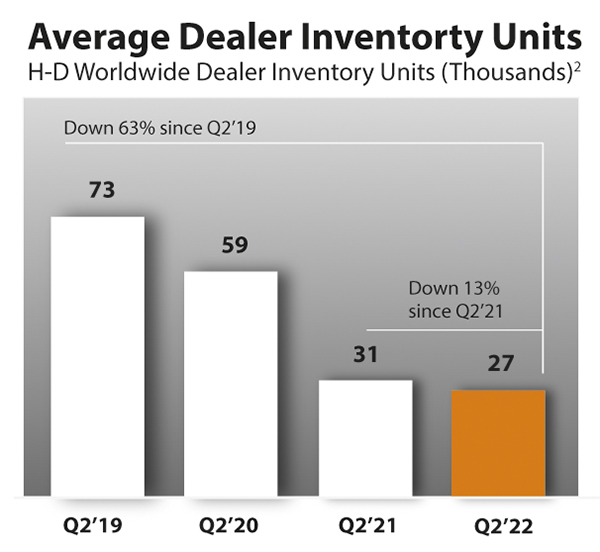

Global motorcycle shipments were -15% at 48,200 units in Q2, with revenue arising down by only -5% thanks to global pricing across Motorcycles, Parts & Accessories, and Apparel (+39%) partially offsetting the decline in wholesale shipments.

Second quarter gross margin was flat compared to Q2 prior year. Global pricing and mix contributed approximately 6 points of margin benefit and more than offset cost inflation. Second quarter operating margin improved to 15.1% from 14.0% in Q2 prior year.

Global retail motorcycle sales in the second quarter were down -23% versus prior year at 50,500 units compared to 65,300 for the year-ago. North America was hardest hit at -28% (34,900 units); ENEA was -15% at 8,700 units; Latin America -8% (800 units) and Asia Pacific +1% at 6,000 units.

HDFS' operating income decline of $9m versus Q2 2021 was driven by a higher provision for credit losses. Total quarter ending financing receivables were $7.1bn, which was up 3% versus prior year.

The company paid cash dividends of $0.1575 per share in Q2 2022 and repurchased $64m of shares (or 1.7 million shares); YTD the company repurchased $312m of shares (or 8.0 million shares).

As stated, for the full year 2022, the company reaffirms its initial guidance and says it continues to expect HDMC revenue growth of 5 to 10%; HDMC operating income margin of 11 to 12%; HDFS operating income to decline by 20 to 25% and capital investments of $190m to $220m.

"The outlook continues to assume that manufacturing, logistics and material costs moderately improve in the back-half of the year as overall operations performance stabilizes and we get beyond the peak levels of inflation experienced in 2021.

"The company's cash allocation priorities are to fund growth through The Hardwire initiatives, pay dividends, and execute discretionary share repurchases."