H-D Q3 - Unit Revenue, Shipments and Retail All Down, Gross Profit Down, EPS Down; "Strategy Remains Grounded in Desirability and Profitability"

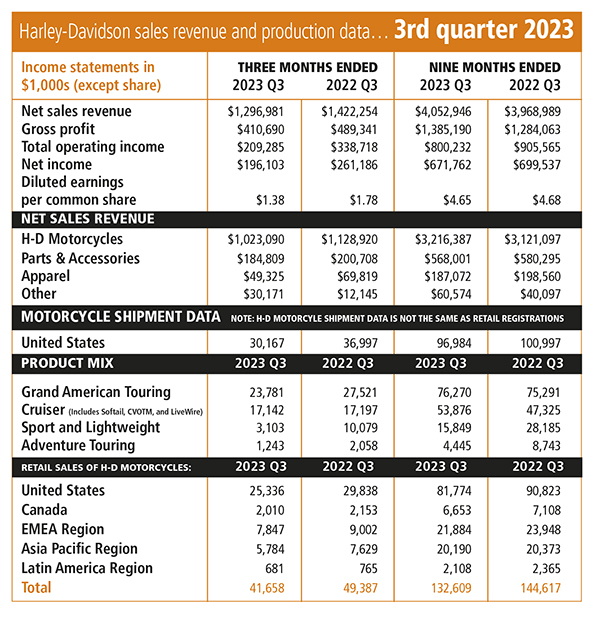

Although HDMC Revenue was up +2% versus the prior year on a YTD/9-month basis - "with global pricing and improved mix offsetting lower wholesale motorcycle unit shipments" - Harley's Q3 results saw an HDMC Revenue decline of -9%, behind a -20% decrease in wholesale shipments for the quarter at 45,269 units, down from 56,855 (-20.4%).

YTD wholesale unit data show Domestic USA down to 96,984 units YTD 2023 from 100,997 (-4.0%) in the comparable year-ago period, with total worldwide unit shipments down to 150,440 units for the first nine months of 2023 compared to 159,544 units for the comparable year-ago period (-5.7%).

In model mix terms, Harley's move away from theoretically less profitable 'Sport and Lightweight' (S&L) models, continues with Q3 2023 showing a -69.2% decline to 3,103 units in Q3, 2023 from 10,079 for the year ago; YTD S&L shipments are at 15,849 units compared to 28,185 for the year ago (-43.8%).

Alarmingly, the Pan America models (Adventure Touring segment) are also down at 1,243 units for Q3, 2023 from 2,058 for the year ago (-39.6%) and 4,445 units for the YTD 2023 from 28,185 for the year ago nine-month period (-84.2%).

Despite the apparent popularity of the new CVO models, a +1.3% growth in the 'Grand American Touring' segment in YTD terms (76,270 units is modestly up from the year-ago of 75,291 units), the Q3 data shows a decline of -13.6% from 27,521 units in Q3 of 2022 to 23,781 units in Q3, 2023.

Worldwide Cruiser shipments are broadly flat for Q3, 2023 (17,142 units against 17,197 for the year ago), but were +13.8% up for the YTD at 53,876 units from 47,325 for the year ago.

This data excludes LiveWire units - which were 50 units in Q3, 2023 (down from 206 in the year-ago) and 146 for the first nine months of 2023 (down from 528 in the year-ago).

In Unit Retail Sales terms, the domestic U.S. market was worth 25,336 units in Q3, 2023, down from 29,839 units in 2022 (-15.1%). Worldwide Unit Retail was 132,609 for the first nine months of 2023, against 144,617 for the year-ago (-8.33%).

"Against a challenging macro and consumer backdrop, we have been able to achieve a result that preserves profitability at an industry-leading level. In addition, we successfully launched our pinnacle CVO motorcycles, with CVO retail sales up 25%," said Jochen Zeitz, Chairman, President and CEO, Harley-Davidson.

"Harley-Davidson remains committed to its Hardwire strategy with a focus on both desirability and profitability, and we will do everything possible to achieve our goals while being realistic that current market conditions are complex. We are gearing up for '24 and will ensure that we are fully aligned and ready as we close out the year with Q4."

Harley is citing Q3 highlights including the successful launch of those two new CVO motorcycles, a HDMC gross margin of 31.7%, a 155 increase in HDFS revenue (on higher interest income) and production of the LiveWire S2 platform Del Mar electric motorcycle having started.

Parts & Accessories revenue was down -8% largely in line with revenue from Motorcycles. Apparel revenue was down -29%, driven by lower volumes in North America.

Third quarter gross margin was down 2.7 points behind the impacts of lower volumes, unfavorable manufacturing impacts and foreign currency, more than offsetting the benefits of pricing and shipment mix. Third quarter operating income margin fell by 6.1 points due to higher operating expense, including higher people costs and marketing spend.

The company is also citing the impacts of the Q2 production shutdown lasting longer than anticipated and as not yet having been fully unwound by the end of Q3, with the effects of recovering ground from the shutdown still likely to be affecting Q4.

Despite what looks like a poor quarter in terms of the long-term impacts of weakening trading, Harley has reaffirmed its most recent full year 2023 growth outlook of flat to +3% and operating income margin of 13.9 to 14.3%. Production of 2023 models finished week ending October 21.