Polaris Q1 Sales Revenues Slide by More than 12%; Speetzen - "The only US Headquartered Powersports Company Stands to be Hit Hardest"

Indian Motorcycle owner Polaris industries have reported first quarter sales "in line with expectations" at $1,536m, down 12% compared to last year.

Primary factors said to be affecting first quarter sales were lower volume due to planned shipment reductions and lower net pricing - "driven by higher promotional spend partially offset by positive mix."

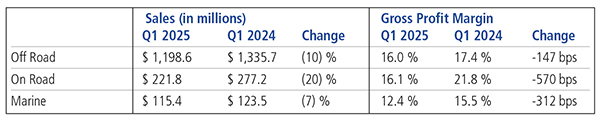

The company says that overall powersports retail sales for the quarter were down 7% versus last year, and that it saw first quarter market share gains in motorcycles and marine - with a "modest" loss of share in its off-road vehicles (ORV) operations.

On Road segment sales were primarily driven to the negative by lower volumes. North America unit retail sales for Indian Motorcycle were down low-teens percent; PG&A sales decreased by 5%. Gross profit margin performance was driven by negative product mix and higher promotional activity, partially offset by operational efficiencies.Unit retail sales for the comparable motorcycle industry were down mid-twenties percent, meaning that Indian Motorcycle saw an increase in market share in a down market with its new PowerPlus heavy weight line up being well received by dealers and riders.

North American Off Road segment sales were down 11% with PG&A up by 1%. The company saw lower volumes in snow and off-road vehicles. Estimated North America industry ORV unit retail sales were down low-single digits percent. Marine segment sales volumes were down.

However, while tariffs had not yet fed through into costs significantly, by the end of March, and despite implementing what it sees as a strong tariff mitigation strategy, Polaris said it had responded to the increasingly widespread volatility in consumer confidence and demand by already implementing much of its "recession play-book" - implying that doing so was much as anything due to the ongoing long-term downward trend in powersports vehicle demand as it was to the likely impacts of tariffs.

As a result of consumer demand and cost landscape uncertainty, Polaris is withdrawing full year 2025 Company sales and adjusted earnings guidance - saying that the present situation "can't be annualised - there are too many moving parts" and that they were moving too quickly.

First quarter reported diluted loss per share was $1.17; adjusted diluted loss per share was $0.90. Cash retention will be one of its primary priorities moving forward - first quarter operating cash flow was $83m.

Though not issuing forward guidance, as such, Polaris is saying that second quarter planning assumptions will include an expectation that total sales will be between $1.6 and $1.8bn; that retail demand will "remain pressured with elevated (and expensive) promotions and dealer shipments lower than retail with dealer inventory being "actively managed", and reduced shipments of Slingshot and Indian Motorcycles to Canada and Europe.

Polaris CEO Mike Speetzen is quoted as saying that "results from this recent quarter were in line with our expectations, as we continued to prioritize supporting our dealer network and managing a prolonged industry downturn.

"While consumer uncertainty and a dynamic tariff environment are near-term hurdles, we are thoughtfully navigating these challenges. Our team continues to make progress on the strategic efforts within our control, from innovation and quality advancements in our lineup to our operational efficiency and working capital efforts.

"We expect this unrelenting focus on long-term growth and profitability will enable us to emerge stronger from this downturn and reinforce our position as the industry leader."

In his Q&A remarks to investment analysts, Speetzen said that: "The only US headquartered powersports company stands to be hit hardest. We had already reduced the China made content of our vehicles by some 15% as a result of decisions taken in 2028. Our objective is to reduce the Chinese made component level by 30 percent in total by the end of 2025."

Speetzen also remarked that "part of consumer caution on big expenditures is triggered by interest rates and people now suspect that they are not now going to come down significantly further this year."

Within the 12% reduction in worldwide sales of $1,536m versus the first quarter of 2024, North America sales of $1,290m represented 84% of total Company sales, decreasing by 11% from $1,444m in 2024. International sales of $246m represented 16% of total Company sales and decreased 16% versus the first quarter of 2024. First quarter operating cash flow was $83m.

For the first quarter, net loss attributable to Polaris was $67m, or $(1.17) per diluted share, compared to net income attributable to Polaris of $4m, or $0.07 per diluted share, for the first quarter of 2024. Adjusted net loss attributable to Polaris for the quarter was $51m, and adjusted EPS was $(0.90).

Gross profit margin decreased 307 basis points to 16.0% for the first quarter; adjusted gross profit margin of 16.6% decreased 242 basis points. Operating expenses were $303m in the first quarter of 2025 compared to $313m in the first quarter of 2024 due to lower R&D and G&A expenses. Operating expenses, as a percentage of sales, of 19.7% were up 170 basis points in the first quarter of 2025 compared to the first quarter of 2024.

.JPG)

.jpg)